In today’s digital-first business environment, fraudulent claims represent a significant financial drain across industries. Whether you’re dealing with employee expense reimbursements, insurance claims, or vendor invoices, fraud can eat away at your bottom line if left unchecked. Modern claim management software offers powerful tools to combat this persistent problem, providing both preventative measures and detection capabilities that traditional systems simply can’t match.

The Growing Challenge of Claim Fraud

Let’s talk numbers: According to the Association of Certified Fraud Examiners (ACFE), organizations lose approximately 5% of their revenue to fraud each year. For small and medium businesses, these losses can be devastating.

Common types of claim fraud include:

- Duplicate submissions (the same claim submitted multiple times)

- Inflated expenses or claims

- Fictitious expenses that never actually occurred

- Misclassified expenses to circumvent policy limitations

- Manipulated documentation or receipts

- Collusion between employees and external vendors

The challenge with fraud detection is that traditional manual processes often miss these issues until it’s too late. Human reviewers can’t possibly cross-reference every claim against historical data, spot subtle document alterations, or identify suspicious patterns across thousands of submissions.

How Modern Claim Management Software Fights Fraud

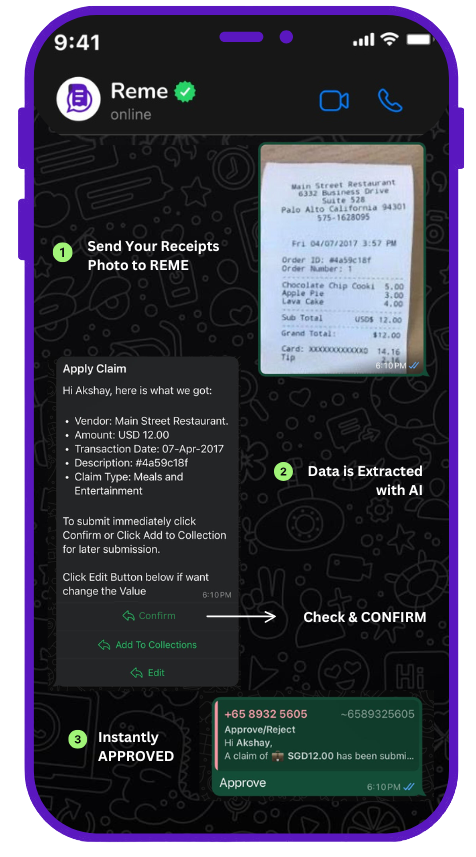

Today’s sophisticated claim management solutions, like REME’s WhatsApp-based platform, incorporate multiple layers of fraud prevention and detection capabilities. Here’s how they’re changing the game:

Automated Document Verification

One of the most powerful features of advanced claim management software is automated document verification. Using technologies like Optical Character Recognition (OCR) and computer vision, these systems can:

- Verify the authenticity of receipts and supporting documents

- Detect alterations or manipulations in submitted documentation

- Cross-check information across multiple fields to ensure consistency

- Flag suspicious formatting, fonts, or other anomalies that might indicate forgery

According to a study published in the Journal of Digital Forensics, automated document verification can identify up to 92% of forged receipts that would go undetected in manual reviews.

Pattern Recognition and Anomaly Detection

Modern claim management platforms employ sophisticated algorithms to identify unusual patterns or anomalies that might indicate fraudulent activity:

- Unusual spending patterns compared to historical data

- Suspicious timing of claims (such as repeatedly submitting just under policy thresholds)

- Geographic inconsistencies (like claiming expenses in locations impossible to reach)

- Statistical outliers in claim amounts or frequencies

These systems establish normal behavior baselines and flag deviations that warrant further investigation, often before the fraud has been fully executed.

Real-Time Cross-Referencing

Unlike manual processes that might take weeks to detect duplicate submissions, claim management software performs instantaneous cross-referencing across vast datasets:

- Checks for duplicate claim submissions across different channels or time periods

- Compares current claims against historical data to identify inconsistencies

- Cross-references vendor information against approved supplier databases

- Verifies expense categorization against predefined business rules

REME’s WhatsApp-based system, for instance, can perform these checks the moment a claim is submitted, preventing fraudulent payments before they occur.

Digital Audit Trails

Perhaps one of the most powerful fraud deterrents is the comprehensive digital audit trail created by modern claim management systems:

- Every action is timestamped and attributed to specific users

- All approval decisions and modifications are permanently recorded

- Document versions are tracked to prevent after-the-fact alterations

- System access logs create accountability at every step of the process

This level of transparency makes it significantly harder to commit fraud without detection, serving as both a preventative measure and an investigative tool when suspected fraud does occur.

AI-Powered Risk Scoring

Advanced claim management solutions leverage artificial intelligence to assign risk scores to incoming claims based on multiple factors:

- Claimant’s historical behavior and compliance

- Similarity to previously identified fraudulent patterns

- Presence of known fraud indicators or red flags

- Statistical probability analysis based on industry benchmarks

These risk scores allow organizations to focus human review resources on the most suspicious claims while fast-tracking low-risk submissions, creating both efficiency and better fraud detection.

Policy Automation and Enforcement

Many fraudulent claims succeed because policies are inconsistently applied or easily circumvented. Claim management software addresses this through:

- Automated policy enforcement at the point of submission

- Consistent application of spending limits and approval thresholds

- Mandatory documentation requirements based on claim type or amount

- Multi-level approval workflows for high-risk or high-value claims

By removing human discretion from policy enforcement, these systems close loopholes that fraudsters often exploit.

The WhatsApp Advantage in Fraud Prevention

WhatsApp-based claim management solutions like REME offer unique advantages in the fight against fraud:

Timestamped, Geotagged Submissions

When employees submit claims via WhatsApp, each submission is automatically timestamped and can include location data, making it much harder to falsify when and where an expense occurred.

Real-Time Verification

Managers can request additional documentation or clarification instantly through the same WhatsApp channel, reducing the window of opportunity for fraudsters to create or modify supporting documents.

Familiar Interface, Higher Compliance

Because employees are already comfortable with WhatsApp, they’re more likely to submit claims promptly and correctly, creating a more complete data set that makes anomalies easier to detect.

Continuous Monitoring

Unlike batch-processed systems that might review claims weekly or monthly, WhatsApp-based solutions enable continuous monitoring and immediate alerts when suspicious activity is detected.

Implementing Fraud-Resistant Claim Management

If you’re considering upgrading your claim management processes to better combat fraud, here are key steps to success:

- Assess your current vulnerabilities – Understand where fraud is most likely occurring in your existing processes

- Clearly define your policies – Effective fraud prevention requires well-documented, unambiguous policies

- Choose technology with robust security features – Look for solutions with end-to-end encryption and secure authentication

- Train your team – Even the best software requires knowledgeable users to maximize its fraud-fighting potential

- Start with high-risk areas – Begin implementation in departments or claim types with the highest fraud potential

- Monitor and refine – Regularly review system effectiveness and adjust rules and algorithms as fraud tactics evolve

The Bottom Line: ROI of Fraud Reduction

Investing in sophisticated claim management software delivers measurable returns through fraud reduction alone:

- Decreased financial losses from fraudulent claims

- Reduced investigation costs and recovery efforts

- Lower compliance risks and potential penalties

- Protection of company reputation and stakeholder trust

- More accurate financial planning and forecasting

When combined with the efficiency gains and processing speed improvements these systems provide, the business case becomes compelling for organizations of all sizes.

For businesses looking to protect their bottom line while streamlining operations, platforms like REME offer a powerful combination of user-friendly interfaces and sophisticated fraud prevention capabilities. By leveraging familiar technology like WhatsApp while incorporating advanced security features, these solutions make it easier than ever to implement robust claim management without disrupting day-to-day operations.

In today’s digital business landscape, effective fraud prevention isn’t just about catching bad actors—it’s about creating systems where fraud becomes increasingly difficult to attempt and impossible to scale. Modern claim management software provides exactly that protection.